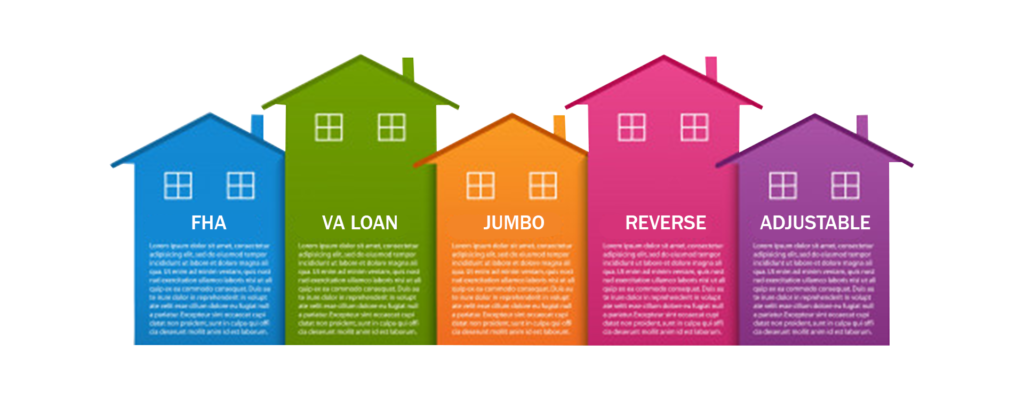

Learn About The Various Home Loan Types

Loan types such as FHA, VA, jumbo, reverse, and adjustable.

FHA LOAN

As low as 3.5% down

You may qualify for an FHA loan with a lower credit score than other loans, and a down payment as low as 3.5%. As of 2019, you can borrow up to 96.5% of the value of a home with an FHA loan (meaning you’ll need to make a down payment of only 3.5%). You’ll need a credit score of at least 580 to qualify. If your credit score falls between 500 and 579, you can still get an FHA loan provided you can make a 10% down payment. With FHA loans, your down payment can come from savings, a financial gift from a family member or a grant for down-payment assistance.

VA LOAN

100% Financing

Qualified veterans, service members and spouses can finance up to 100% of their loan and pay less at closing. VA Home Loans are provided by private lenders, such as banks and mortgage companies. VA guarantees a portion of the loan, enabling the lender to provide you with more favorable terms. If you qualify, you can buy or build a home, or refinance an existing home mortgage, with as little as $0 down, great rates, and financing up to $484,350 (2019 limit) – more if you live in certain high-cost areas like New York City. Another benefit over traditional mortgages is that there is no PMI (Private Mortgage Insurance, the monthly insurance fee charged to protect the bank until you reach at least 20 percent equity).

JUMBO LOAN

Small interest rates

A jumbo loan, also known as a jumbo mortgage, is a type of financing that exceeds the limits set by the Federal Housing Finance Agency (FHFA). Unlike conventional mortgages, a jumbo loan is not eligible to be purchased, guaranteed, or securitized by Fannie Mae or Freddie Mac. Designed to finance luxury properties and homes in highly competitive local real estate markets, jumbo mortgages come with unique underwriting requirements and tax implications. These kinds of mortgages have gained traction as the housing market continues to recover following the Great Recession.

REVERSE LOAN

62 and older

In a word, a reverse mortgage is a loan. A homeowner who is 62 or older and has considerable home equity can borrow against the value of their home and receive funds as a lump sum, fixed monthly payment or line of credit. Unlike a forward mortgage—the type used to buy a home—a reverse mortgage doesn’t require the homeowner to make any loan payments. Instead, the entire loan balance becomes due and payable when the borrower dies, moves away permanently or sells the home. Federal regulations require lenders to structure the transaction so the loan amount doesn’t exceed the home’s value and the borrower or borrower’s estate won’t be held responsible for paying the difference if the loan balance does become larger than the home’s value. One way this could happen is through a drop in the home’s market value; another is if the borrower lives a long time.

ADJUSTABLE LOAN

Low fixed interest rate

An adjustable-rate mortgage (ARM) is a type of mortgage in which the interest rate applied on the outstanding balance varies throughout the life of the loan. With an adjustable-rate mortgage, the initial interest rate is fixed for a period of time, after which it resets periodically, often every year or even monthly. A variable rate mortgage is another name for an ARM, which take a number of different forms. Floating rate mortgage is another name for one. A variable-rate mortgage, or ARM, has an interest rate reset based on a benchmark or index, plus an additional spread, called an ARM margin.

NEED IMMEDIATE ASSISTANCE?

Go live with one of our mortgage professionals and get immediate assistance with your loan questions